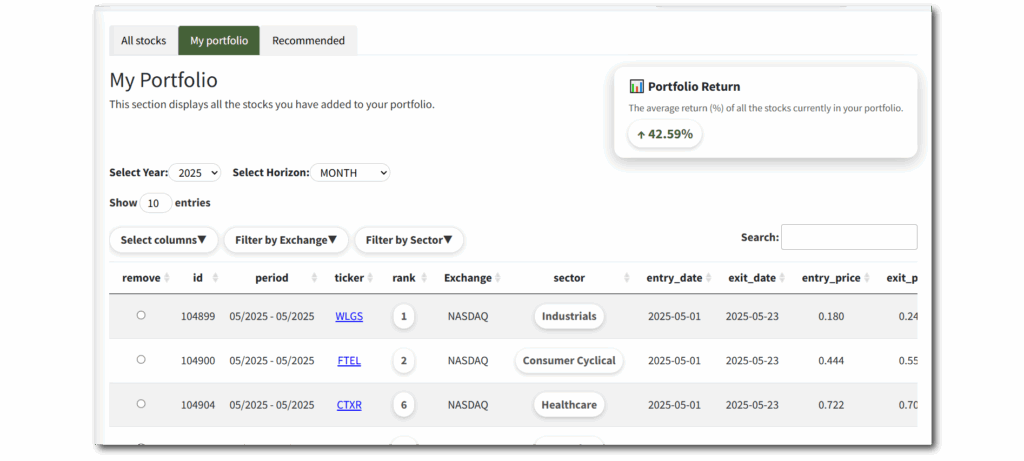

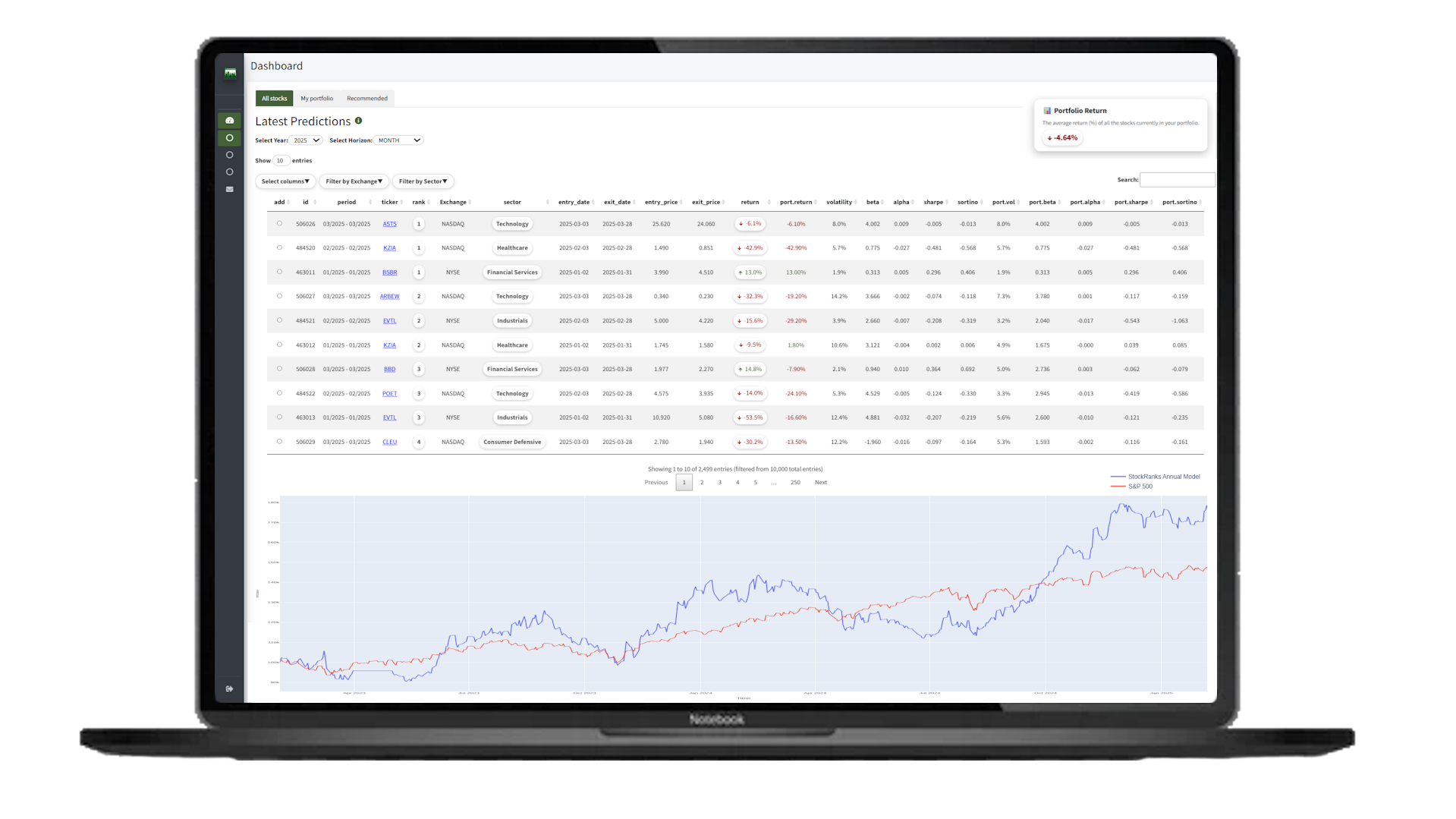

StockRanks offers users a ranking of the most promising stocks for the upcoming investing period, allowing for efficient sorting and filtering by industry. This enables the formation of profitable portfolios by focusing on top-ranked stocks. The tool is designed to detect investing opportunities by recognizing patterns in price behavior, company fundamentals, macroeconomic conditions, and technical price indicators.